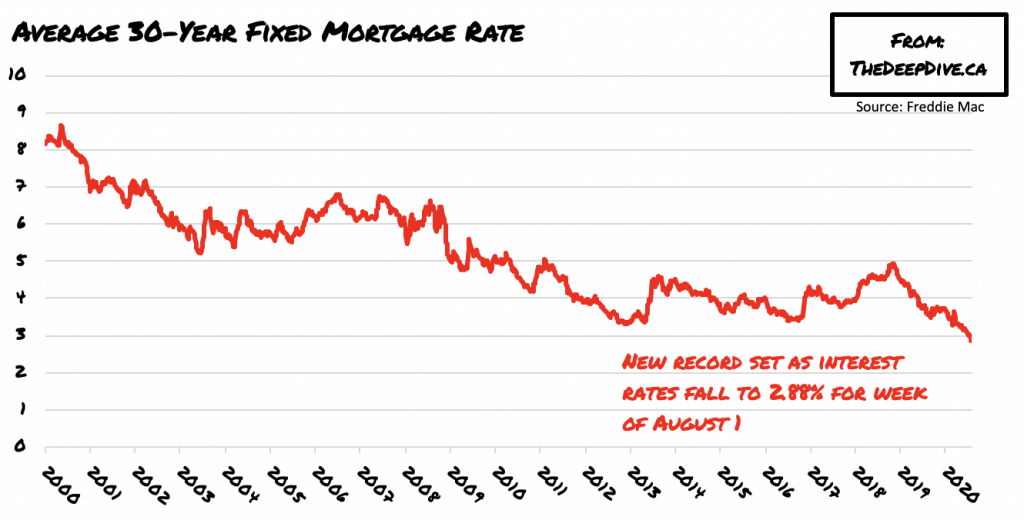

As a result of federal government and Federal Reserve working aggressively to keep the US economy from completely falling into financial ruin, mortgage rates have been falling drastically to new record lows. The average interest rate on a 30-year mortgage fell from 2.99% to a record-breaking 2.88% last week. However, despite the attractively low interest rates, an increasing number of potential home buyers have suddenly been shying away from the housing market.

According to the Mortgage Bankers Association, the total number of mortgage applications decreased by 5.1% compared to the prior week, while refinance applications dropped by 7%. In the meantime, the average loan amount has been steadily rising, suggesting that some potential homebuyers are being crowded out of the market due to rising home prices.

In July, the average median home price reached $349,000, which is an increase of 8.5% compared to the same time a year prior, according to the Housing Recovery Index compiled by realtor.com. Moreover, housing inventory also declined by 34.8% in July compared to the same time a year prior; conversely, June’s inventory only fell by 26.5% compared to 2019 levels.

Although declining inventories are causing home prices to rise, the situation is becoming vastly different in metro areas. According to Redfin, the average selling price of a condo in the US dropped by 1.4% in June, compared to the same month in 2019. Condo sales also decreased by 31.3% in June compared to last year, while sales of single family homes declined by 11.9% as well. Redfin economist Taylor Marr notes that the inverse in homebuyer attitudes suggests that the coronavirus pandemic has a contributing impact on what homebuyers are looking for in a house.

As many businesses have shifted to remote workplaces for their employees, an increasing number of potential home buyers will now be requiring an at-home office. As a result of needing to spend more time at home, people have been opting for more spacious housing that encompass backyards and privacy. Moreover, given the continued risk from soaring coronavirus infections across the US, Americans have been shying away from shared living arrangements such as gyms, pools, and elevators – amenities that are typically offered in condo buildings.

Information for this briefing was found via Mortgage Bankers Association, Realtor.com, and Redfin. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.