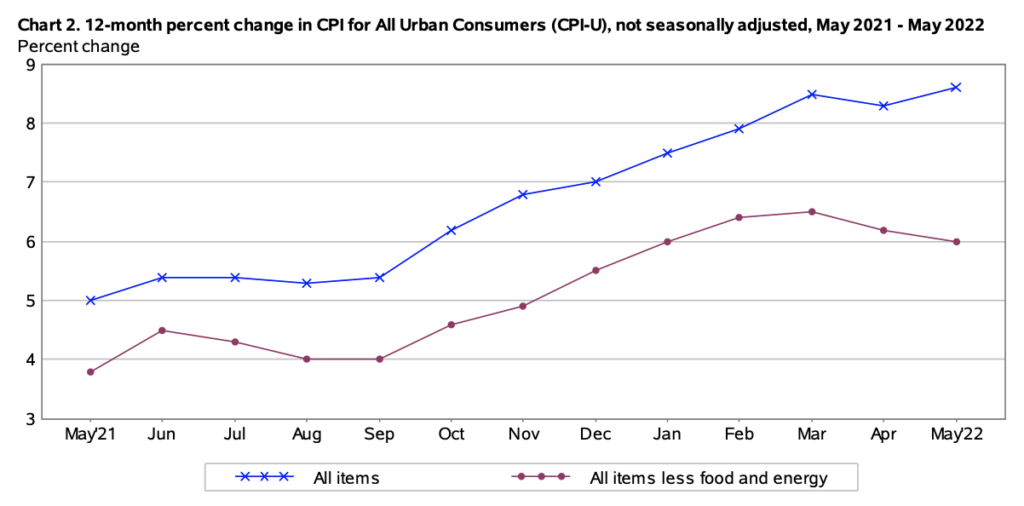

After briefly flatlining in April, it appears that US consumer prices jumped back into rhythm for the 24th consecutive month, throwing away any hope for team ‘transitory’ or ‘peak’ inflation.

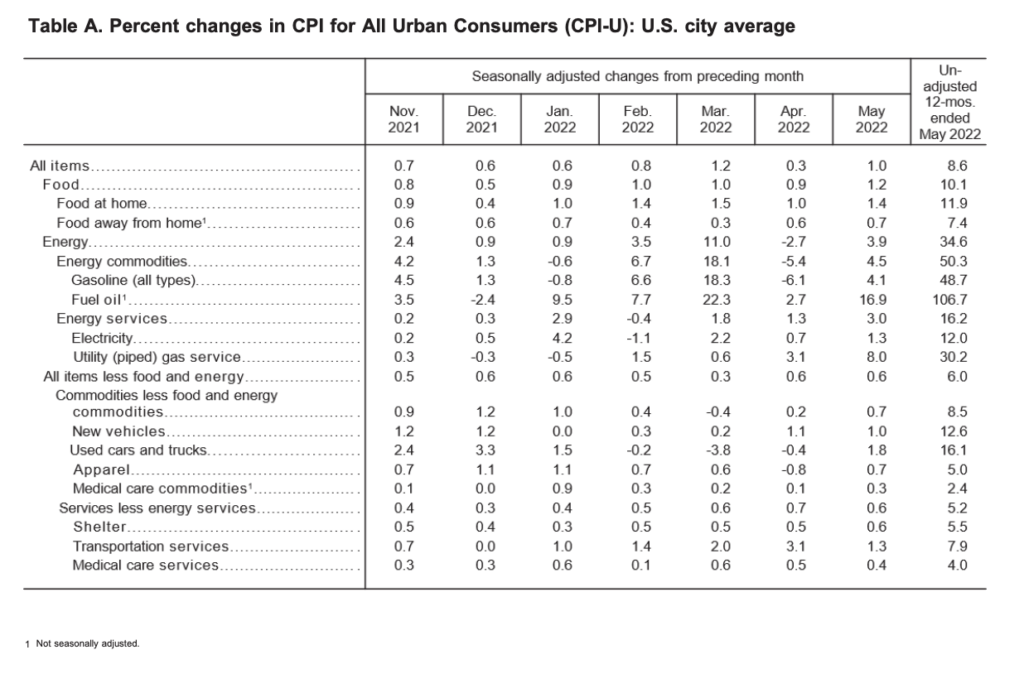

Latest data from the BLS showed that CPI rose 1% between April and May to an annualized 8.6%— the highest since December 1981 and substantially higher than the 8.3% forecast by economists polled by Bloomberg. Core CPI also didn’t offer Americans any relief, rising by yet another 0.6% month-over-month to 6% from May 2021.

Looking under the hood, the relentless surge in energy costs showed no respite in May, rising 34.6% since last year to mark the biggest annual increase since September 2005. Indeed, all components noted record-breaking increases, with shelter, airline fares, used cars and trucks, and new vehicles also dominating last month’s inflation print.

But, the most alarming were the sharp increases in food costs, particularly for chicken, eggs, and milk. Good thing the average consumer doesn’t need any of those! Making the situation a whole lot worse, though, is the despairing decline in real average hourly earnings, which fell 3% in the past 12 months. So, the cost of things Americans are actually buying is outpacing the rise in their wages for the 14th straight month.

Groceries +11.9% y/y –>Biggest inc. since 1979

— Heather Long (@byHeatherLong) June 10, 2022

Chicken +17.4% ->Largest ever

Restaurants +9% -> Largest ever

Fuel oil +107% ->Largest ever

Electricity +12% ->Largest since '06

Rent +5.2% ->Largest since 1987

Airfare +37.8% ->Largest since 1980

Services +5.7% ->Largest since 1990

But, don’t worry, if Joe Biden said there is no unchecked inflation on the way, he MUST be right— after all, he is a government official.

INFLATION: President Biden says, "There's nobody suggesting there's unchecked inflation on the way, no serious economist." pic.twitter.com/VofmVi4s8e

— Forbes (@Forbes) July 19, 2021

Information for this briefing was found via the BLS and twitter. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.