Recent data releases and analyses indicate a concerning trend in the US job market, raising alarm about a potential economic downturn. Two prominent surveys, the Establishment Survey and the Household Survey, have provided conflicting signals, contributing to uncertainty regarding the true state of employment in the country.

THREAD about fast deteriorating US job mkt.

— Jeffrey P. Snider (@JeffSnider_EDU) March 10, 2024

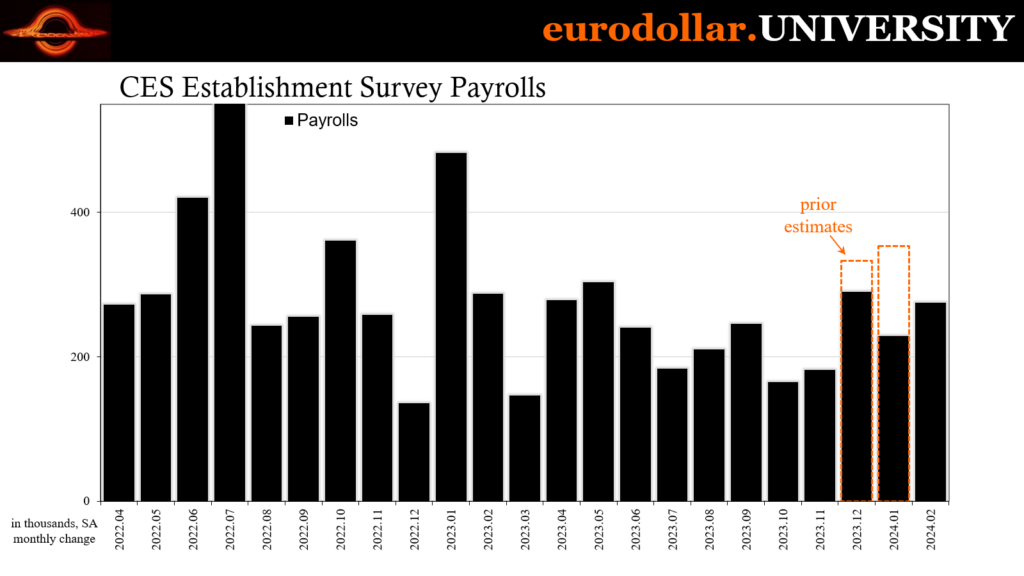

Est Survey (payrolls) has become a punchline not a useful measure of jobs.

HH Survey (employment) just gave us THREE clear, historically validated recession signals – including the unemployment rate.https://t.co/nRgt7lND5z

First,… pic.twitter.com/5FRE1pbjjg

The Establishment Survey, traditionally viewed as a benchmark for job market health, has come under scrutiny by observers for its unreliability. Initial reports often tout significant job gains, only to be revised downward substantially in subsequent months. The latest revisions have been particularly stark, with December’s figures slashed by 43,000 and January’s by a staggering 124,000.

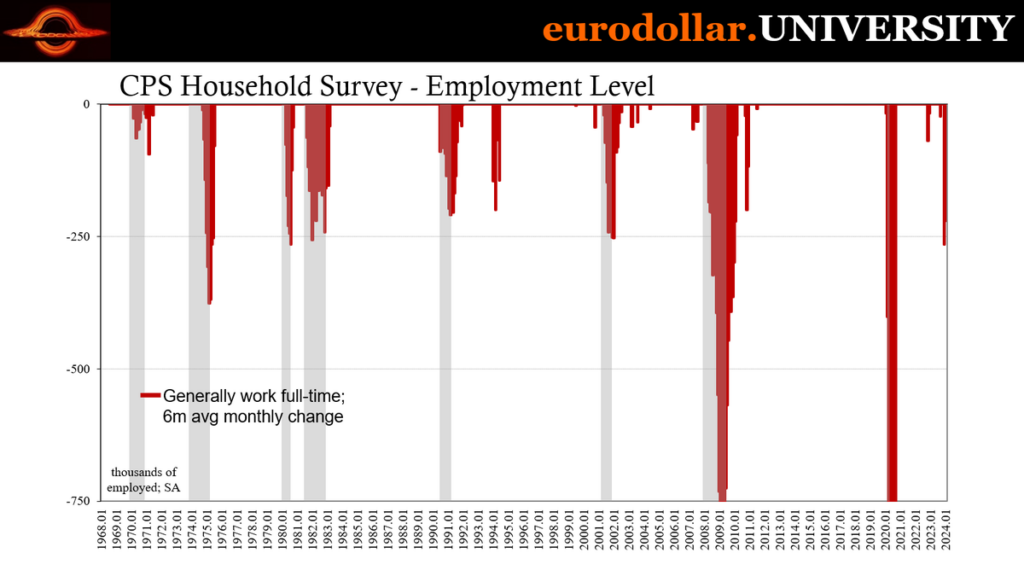

In parallel, the Household Survey, which tracks employment trends among households, has offered three distinct recession indicators. Over the past six months, the survey has consistently shown a contraction in employment, with an average decline of 89,000 jobs per month—a pattern historically associated with economic downturns.

Moreover, the decline in full-time jobs further underscores the severity of the situation. Businesses are not only reducing their workforce but also scaling back employees’ hours—a phenomenon that typically accompanies recessions and has been observed across various sectors.

Concerns are further compounded by the uptick in the unemployment rate, which climbed from 3.7% in January to 3.9% in February—the highest level in two years. Despite a seemingly low unemployment rate, the direction and sustained increase of this metric over the past ten months signal underlying economic troubles. Such a prolonged uptick in unemployment rates has historically coincided with recessionary periods.

UR may be what most have been talking about given that it went up from 3.7% in Jan to 3.9% in Feb which is the highest in 2 yrs (since Jan 2022) and 0.5 pp above the cycle low.

— Marko Bjegovic (@MBjegovic) March 9, 2024

Problem is that just like NFP, UR might get revised down (this happened in Oct when we first thought… pic.twitter.com/AWgvu8yTF4

Additional factors, including the state of part-time employment, corroborate the ominous signs emanating from the job market. These multifaceted indicators paint a bleak picture, indicating that the economy may already be in recessionary territory.

The latest employment report for February presents a mixed bag of results, with underlying weaknesses overshadowing apparent strengths. While non-farm payroll numbers appeared robust at a gain of 275,000 jobs, consistent downward revisions in previous months raise doubts about the accuracy of these figures.

Wage growth, as measured by Average Hourly Earnings (AHE), also remained unexpectedly sluggish, indicating a lack of momentum in the labor market.

Feb Employment report in a nutshell:

— Marko Bjegovic (@MBjegovic) March 9, 2024

💥NFP are strong (but subject to revisions)

💥UR could potentially end up sounding the #recession alarm

💥AHE show wage growth in line with what the #Fed desires

6/8

“It’s not just some datapoints spit out by the government. This is in the real economy. The reason it ‘feels’ like a recession is because it already is,” posted Eurodollar University channel host Jeffrey P. Snider.

According to a Reuters survey of economists, the consensus forecast for February anticipated the addition of 200,000 jobs, with projected figures spanning from 125,000 to 286,000. This anticipated job growth surpasses the approximate requirement of 100,000 jobs per month to accommodate the expanding working-age population, more than doubling the necessary threshold.

Information for this story was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.