On February 7th, The Valens Company (TSX: VLNS) held its 2022 investor day. The company outlined in a news release where management speaks on the company’s strengths while announcing it has identified an additional $10 million of annual cost saving. This comes in the form of operation efficiencies, removal of underperforming SKU’s, automation, and contract growth.

A number of analysts lowered their 12-month price target on Valens after the investor day, bringing the average 12-month price target down to C$10.53, or a 313% upside to the current stock price. There are currently 7 analysts covering the stock with 1 analyst having a strong buy rating, 5 have buys and 1 analyst has a hold rating on the stock. The street high sits at C$15.75, which represents a 518% upside while the lowest price target comes in at $7.50 from two analysts.

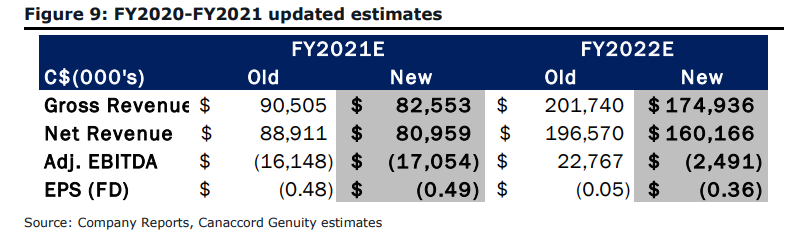

In Canaccord Genuity’s note, they reiterate their speculative buy rating but lower their 12-month price target from C$11 to C$9, saying that they have lowered their full-year 2021 and 2022 estimates as the company gave an update on their operations and key objectives.

Canaccord notes that the most important takeaway from the investor day might have been management highlighting Valens transition from a white-label or processing company to a branded products company. Interestingly, Valens expects bankruptcies to leave roughly 25% of the market unaccounted for. For this reason, they expect that branded sales will be between 40% and 50% of their full-year sales in 2022 and beyond.

For the company’s U.S asset, Valens expects that between COVID pressures forcing the shutdown of many smaller CBD operators and a new e-commerce platform, they believe that the CBD sales to account for 25% to 35% of the company’s total 2022 sales.

Lastly, the company’s main focus on the financial side comes by promising cost-saving, as 2021 was a big M&A year for Valens. They additionally offered 2023 guidance as they expect revenue to be greater than C$225 million with greater than 10% EBITDA margins. The company also added that growth might slow due to softer B2B sales and the elimination of toll processing.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.