Volkswagen’s July 26 announcement that it will invest US$700 million to gain an approximate 5% in Chinese electric vehicle (EV) maker Xpeng looks like a win-win transaction for both parties. Xpeng shares soared 34% on the news. A near-term benefit for VW is that VW/Xpeng plan to jointly develop two new EVs for the Chinese market under the VW brand; these vehicles are expected to begin selling in 2026.

Importantly, the rationale for the deal could have positive implications for other startup EV makers, including Rivian Automotive, Inc. (NASDAQ: RIVN).

VW likely decided to invest in Xpeng because its own EVs were losing traction in the Chinese market. VW sold about 62,000 EVs in China in the first half of 2023, down 2% from its sales volume there in 1H 2022. While this downtick does not appear especially concerning on the surface, it is quite disappointing from the perspective of the overall Chinese market; total EV sales in China rose 30% year-over-year in 1H 2023 to around 2.5 million units.

On a consolidated basis, China is vital to VW. About 40% of its sales are in China (including of course conventional internal combustion engine-powered cars), which translates to around half of VW’s overall profits.

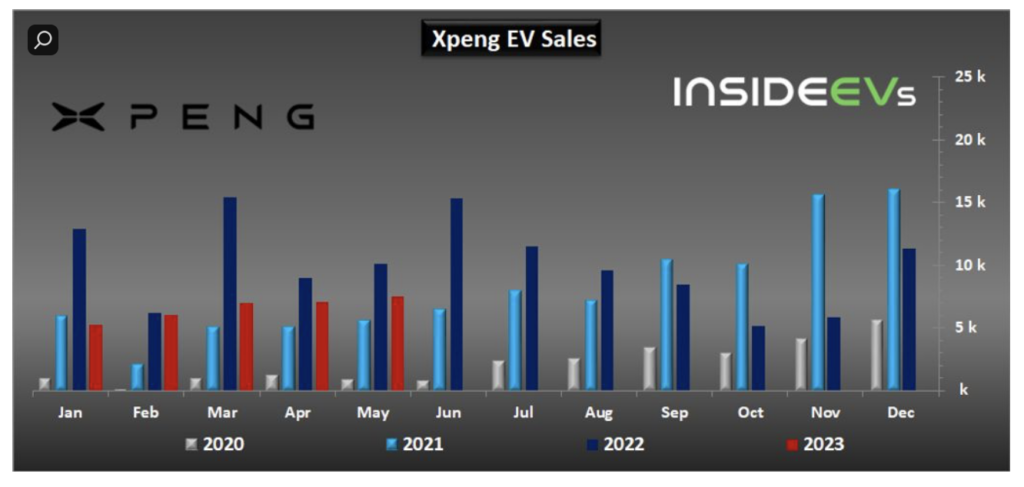

Xpeng’s sales results in China have been even worse. Despite offering more than 10% discounts on several models beginning in January 2023, the company sold only 41,435 units in 1H 2023, down 40% from the year-ago period. Furthermore, this sharp percentage decline has been quite consistent throughout the first half of 2023: June 2023 and 2Q 2023 sales were down 44% and 33%, respectively.

It is possible that VW’s investment in and joint vehicle development agreement with Xpeng could prove to be something of a template for EV corporate transactions in the future. It is not difficult to imagine a legacy auto manufacturer which is struggling to establish its own EV models investing in a small (in terms of revenue, if not market cap), but growing EV manufacturer like Rivian. Such a partnership would likely boost investor confidence both in the legacy automaker and in the EV startup.

Rivian could be an ideal partnering candidate because of its fortress balance sheet (US$11.2 billion of cash as of March 31, 2023) and improving vehicle production and delivery profile.

RIVIAN AUTOMOTIVE, INC. — Production/Delivery Statistics

| Full-Year 2023 Guidance | Lifetime Total | Twelve Months Ended 6-30-23 | 2Q 2023 | 1Q 2023 | |

| Number of Vehicles Produced | 50,000 | 48,739 | 40,770 | 13,992 | 9,395 |

| Number of Vehicles Delivered | 41,838 | 35,224 | 12,640 | 7,946 |

Factoring in its net cash position, Rivian’s enterprise value is approximately US$18 billion. Consequently, the stock trades at a fairly reasonable 8x enterprise value-to-revenue multiple. Rivian reports its 2Q 2023 earnings on August 8.

Rivian Automotive, Inc. last traded at US$26.94 on the NASDAQ.

Information for this story was found via Edgar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.