This week WELL Health Technologies (TSX: WELL) announced that they are expanding into the US Market with a majority stake in Circle Medical, a San Francisco based provider of both out-of-pocket and insured telehealth appointments for U.S. patients. They have 18 physicians, nurse practitioners, and other health professionals in 35 different states that do online visits and two brick and mortar clinics in San Francisco.

Circle Medical currently does U$5 million in revenue a year and is profitable. WELL Health will pay U$14 million for a 56-60% stake in the company, its a mix of U$5 million cash and U$9 million worth of shares at $4.77 per share. Concurrent with the M&A, WELL Health conducted a private placement for C$23 million.

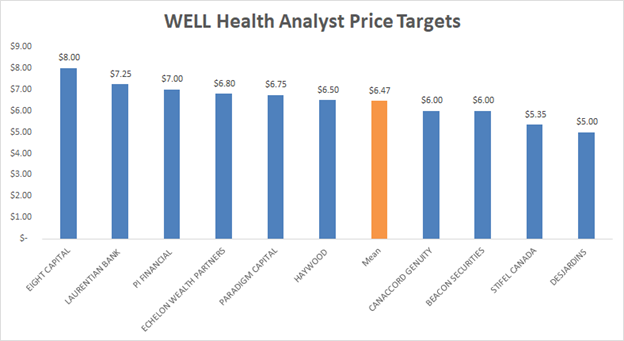

There have been several price target changes on the company as a result of the news, including:

- Canaccord Genuity raises target price to C$6 from C$4.75

- Eight Capital raises target price to C$8 from C$5

- PI Financial raises target price to C$7 from C$4.90

- Laurentian Bank securities raises target price to C$7.25 from C$5.25

Currently there are 10 analysts who cover the stock. Three analysts have strong buy ratings while the other seven have buy ratings on the stock. The highest price target on WELL comes from Eight Capital with their new C$8 price target which is a 20.5% upside to the stock, while the lowest price target comes from Desjardins with a C$5 price target which is a 25% downside. The mean price target is C$6.47.

Canaccord has made changes to its forecasts for the full year 2021 revenue and EBITDA as a result of the acquisition. Canaccord now estimates $61.7 million, up from $52.7 million and $4.5 million, up from $4.2 million, for revenue and EBITDA for FY2021.

In P.I. Financial’s note to investors, analyst David Kwan comments, “attractive acquisition, attractive price.” He goes on to say that the Circle deal looks low risk and highly attractive. Based on their annual recurring revenue of roughly U$5 million, the implied valuation of Circle is 5x annual recurring revenue. This is below WELL’s valuation and Kwan says that given this business is “on pace to (well) more than double its sales over the next year and that it just turned profitable in July, the price WELL has agreed to pay looks quite compelling.”

Kawn also says that as the “expansion (is) into the enormous and lucrative U.S. healthcare market,” this acquisition will help propel WELL to make further investments with all it’s dry powder. The U.S. is an attractive market for WELL because the patient economics is much better than Canada, with Circle earning 5-6x the patient fee for a telehealth appointment than WELL does in B.C.

He also estimates that with the C$23 million financing and the U$5 million payment, WELL has close to $40 million in cash to continue it’s M&A. Kwan says that he expects WELL to focus on expanding its footprint in Ontario in the coming quarters.

P.I. Financial increased their full-year 2020 and 2021 revenue estimates for WELL. They now forecast $45 million and $98.4 million for revenue, respectively, while adjusted EBITDA is estimated to be -$1 million and $2.4 million.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.