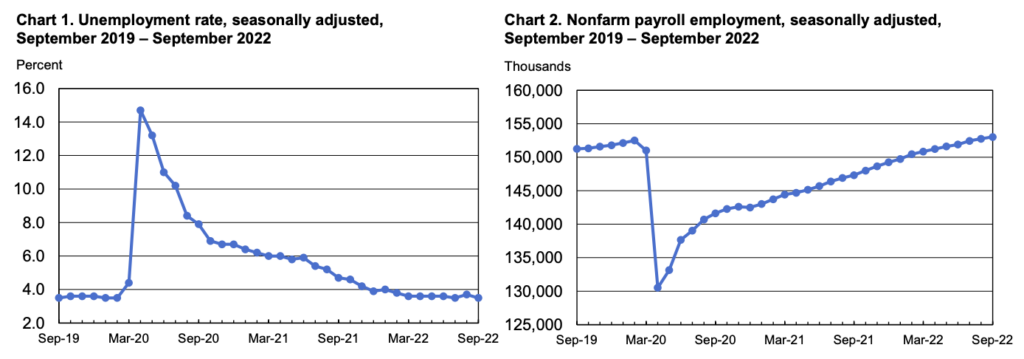

The US labour market remained resilient in September, as businesses continued their hiring spree despite surging inflation and sharp interest rate hikes from the Federal Reserve.

Latest data from the Bureau of Labour Statistics showed nonfarm payrolls jumped 263,000 last month, sending the unemployment rate tumbling from 3.7% to 3.5%. Albeit the advance was smaller than August’s 315,000 gain and the smallest increase since April 2021— the figures exceeded consensus estimates calling for a payrolls gain of 255,000 and the unemployment rate to remain steady at 3.7%. Hiring was broad-based, with the most job gains concentrated across the leisure and hospitality and healthcare sectors.

The latest data suggests the US jobs market is still strong despite other indications of moderating, such as a drop in job openings. Still, many employers remain short-staffed following the pandemic, and continue to hire even amid rising wage growth and monetary policy tightening by the Fed. The BLS jobs report will also be the final one before the central bank’s next meeting in November, and will likely bolster policy makers’ consideration for a fourth consecutive 75 basis-point rate hike.

In fact, the figures show the Fed still has a long and tough road ahead in bringing inflation back to the 2% target range, particularly if wage growth isn’t cooling. Average hourly earnings were up 0.3% from August and 5% from September 2021— a paltry deceleration from the month before, but still nonetheless historically high. The central bank said it remains committed to raising borrowing costs even if it risks sending the US economy into a recession and a softened labour market.

Information for this briefing was found via the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.