RavenQuest Biomed Inc (CSE: RQB) released its third quarter financials last night, posting revenues of $709,642 for the period, a marginal increase from the prior period. However, several red flags are apparent in the firms latest filings, with a major oncoming cash crunch being evident. On the bright side, the firm managed to make its balance sheet actually balance this quarter.

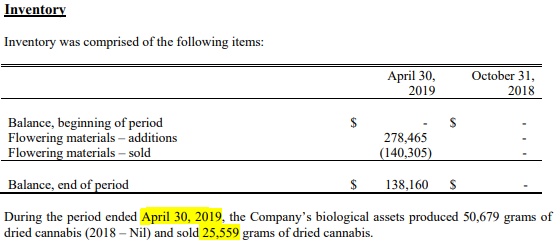

While revenues increased marginally, the make up of it however was vastly changed, with the majority of revenues coming from consulting services while only $47,000 came from the sale of cannabis – down from $216,000 in the second quarter. The figure is curious, as the firm reported no change in total cannabis sold between the six and nine month period for the current fiscal year.

Total expenses came in at $4.14 million during the quarter, up from $3.07 million during the second quarter. The largest expenditures were that of interest and accretion ($898,908), share based compensation ($830,448), and depreciation and amortization ($803,701). Advertising and promotion came in at $369,000, while wages came in at $331,000 – roughly the combined equivalent of total sales for the quarter.

What remains as one of the most significant concerns for RavenQuest Biomed however, is its current cash position. The firm currently only has $749,135 in cash on hand at the moment – which fails to cover the $2.33 million in current accounts payable due. This doesn’t include the fact that its already seemingly spent all the funds listed as unearned revenue on its balance sheet as well, to the tune of $1.84 million. Total current assets of $2.75 million, including $271,000 in inventory and $477,000 in biological assets, won’t be enough to cover these liabilities either.

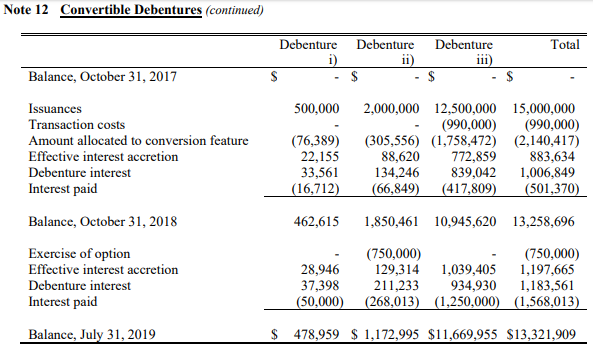

Finally, there is the issue of the currently outstanding convertible debentures. Listed as a liability of $13.32 million, in total $14.25 million remains to be paid out or converted out of the total $15.0 million convertible debentures issued. The debentures, all of which convert at $1.45, are a far cry from converting based on yesterdays closing price of $0.30 per share. What’s more, is they mature February 28, 2020 – leaving just under five months for RavenQuest to come up with the cash required to cover the debt, before interest is even considered.

The only bright side related to the debentures, is the fact that they are unsecured. Meaning the company “can” opt not to pay them. While this would undoubtedly hurt the future prospects of the firm ever securing funding, its assets would still not be yanked out from under them should they elect not to pay – which is unlike many debentures currently outstanding in the sector. Nevertheless, the firm is in trouble when it comes to funding and has a grim outlook on its future.

RavenQuest Biomed closed yesterdays session at $0.30 on the Canadian Securities Exchange.

Information for this briefing was found via Sedar and RavenQuest Biomed. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.