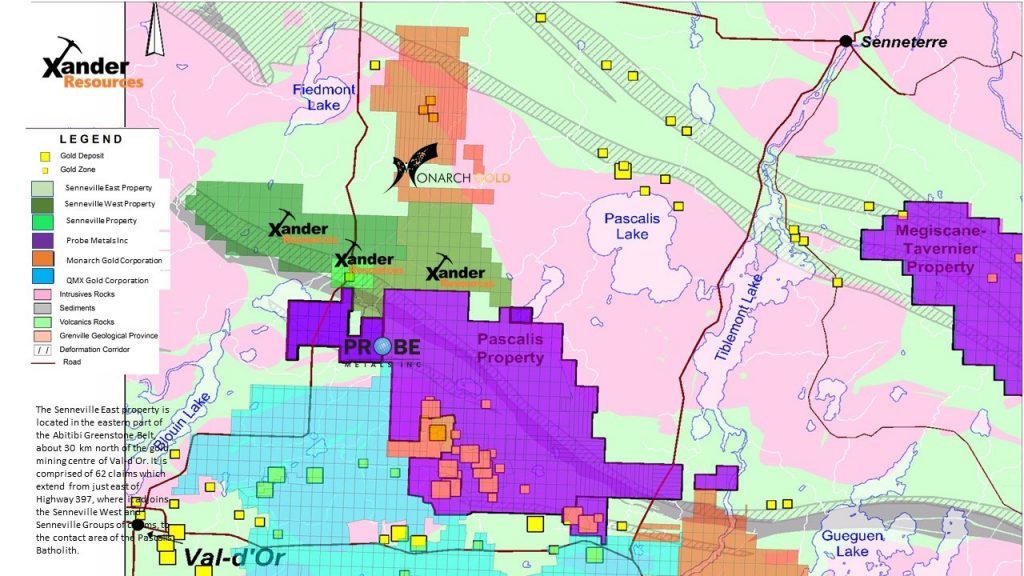

Xander Resources (TSXV: XND) this morning announced that it has expanded its claims to over 21,000 acres at its Senneville Group of properties in the Val-d’Or camp. The property is located in the eastern portion of the Abitibi Greenstone Belt.

The new property, referred to as Senneville East, is comprised of 62 claims. The claims extend east of Highway 397, where it joins Xander’s Senneville West and South Group of Claims, forming a contiguous claim. The most recent drilling on the property occurred in 2012, wherein two of three drill holes reported 9.79 grams per tonne gold over 1.0 metre, and 11.03 grams per tonne gold over 1 metre.

The most eastern portion of the new claims lies overtop of the contact point for the Lanaudiere Formation Volcanics and the Pascalis Batholith, with this border being the site of many significant gold showings. The Mackenzie Break deposit lies on the on the western side of the intrusive, with previous documentation indicating this region should be explored.

The additional property is to be acquired via an option with a purchase letter agreement on May 18, 2020 whereby the company is to enter an exclusive option to purchase a 100% interest in the 62 mineral claims. A 2% net smelter royalty will be applied to the property, in addition to the following:

- 450,000 common shares before closing, which is expected to be July 15, 2020.

- $5,400 in cash payable on or before closing.

- $4,000 cash paid within 90 days of closing.

- 410,000 common shares and $12,000 cash issued at the 18 month anniversary of closing.

- 230,000 ommon shares and $24,000 cash paid at the 30 month anniversary of closing.

Xander Resources last traded at $0.18 on the TSX Venture.

FULL DISCLOSURE: Xander Resources is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Xander Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.