Xander Resources (TSXV: XND) this morning provided an update to the market in relation to its currently planned drill program at its Val-d’Or property. The company currently anticipates getting drills first into the ground in February 2021, following COVID-19 restrictions recently put into place by the Quebec government.

Drilling is to take place at the Senneville Claim Group, located in Val-d’Or East. The drill program is to comprise of a total of 3,000 metres, with the total program to consist of a nine holes. The initial three holes within the program will look to confirm drilling conducted on the property in 2012.

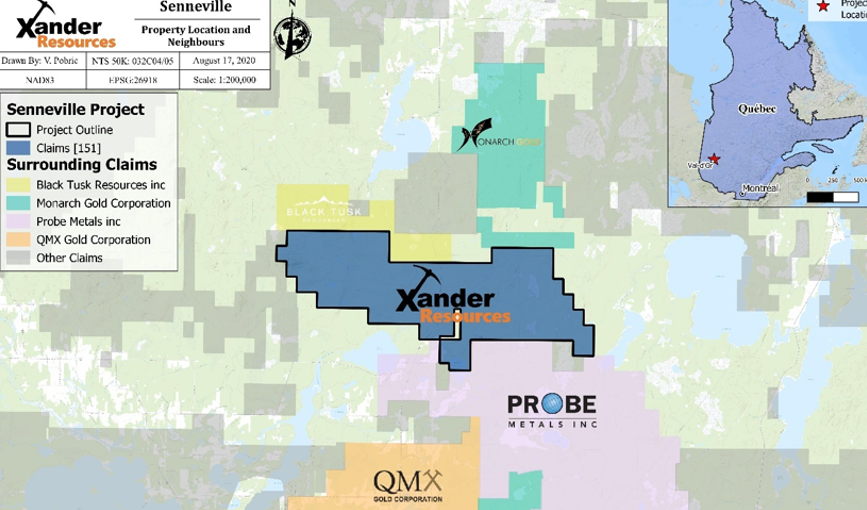

Exploration is said to be conducted just off Highway 397 Nord, which runs through the Senneville Claim Group, 22 kilometres North of Val-d’Or, Quebec. The property itself consists of over 90 square kilometres of claims, while being contiguous to the Prove Metals property that is located to the south, and the Monarch Gold property that is located to the north.

“We are contiguous to Probe Metals who are currently active on the Pascalis Gold Trend where they announced drilling results of 5.9 g/t Au over 9.2 metres. Probe also announced the discovery of two new gold zones, one of which returned 94.1 g/t Au over 0.6 metres. 2.5 kms to the south and contiguous to Probe Metals is QMX Gold who are expanding their Bonnefond deposit where they reported 6.48 g/t Au over 73.2 metres.”

James Hirst, CEO of Xander

Xander Resources last traded at $0.165 on the TSX Venture.

FULL DISCLOSURE: Xander Resources is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Xander Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.