On July 6th, Xebec Adsorption (TSX: XBC) announced a master service agreement with a leading U.S-based renewable natural gas dairy farm project developer. The developer will initially purchase 18 BGX Biostream units with the ability to up the purchased quantity.

Off the back of this news, three analysts changed their 12-month price target with two increasing and one lowering. The company has 13 analysts covering the name, with a weighted 12-month price target of C$5.45 or a 20% upside. The street high sits at C$6.50 from Desjardins while the lowest sits at C$3.50 from Roth Capital. Out of the 13 analysts, one has a strong buy rating, eight have buy ratings and four have hold ratings.

In Canaccord’s note on July 6th, they raised their 12-month price target to C$6.00 from C$4.50 and upgraded Xebec to a buy from a hold rating. They say that this contract validates Biostream. Their analyst adds, “Having dropped 50% year-to-date, we believe Xebec shares afford investors a favourable reward-to-risk proposition.”

Canaccord believes that this agreement could pull in as much as $35 million, which is based on the starting price of U$1.5 million per Biostream unit. The company also announced that to handle the increased demand, Xebec is expanding one of their facilities to produce 35 units. This will bring their total capacity to over 100 units.

This new deal, alongside their other 6 orders, brings Xebec’s market share of the dairy manure RNG US market to 30%. Canaccord says, “The market opportunity is significant, with ~8,574 farms primed for biogas production according to the American Biogas Council.”

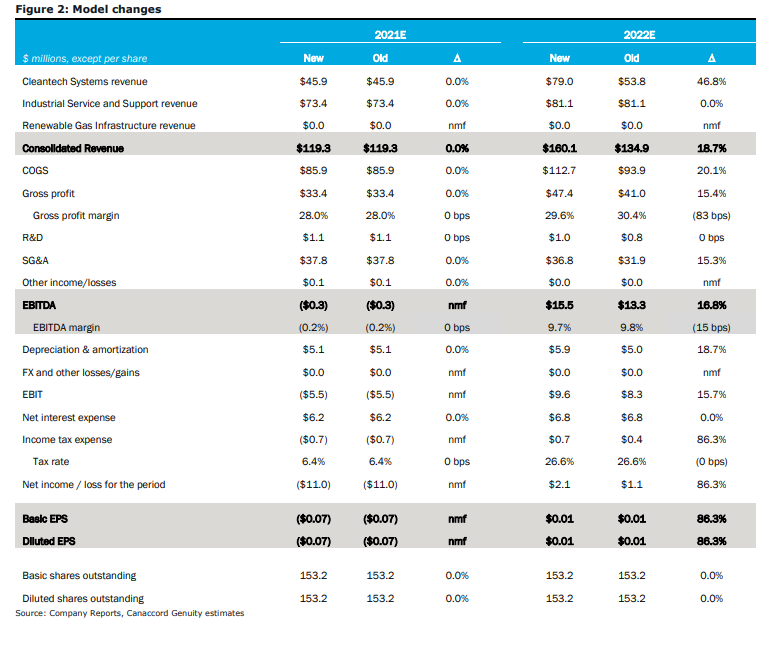

Below you can see Canaccord’s updated estimates for 2021 and 2022.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.