Our value seeking series on the under-performing banking sector kicks off with California-based First Republic Bank of San Francisco (NYSE: FRC). The diversified commercial bank is so well-situated as Silicon Valley’s banker that it’s embedded its branches directly in the headquarters of all the tech names you’ve heard of, thus becoming the personal banking name that high-earning nerds trust. This one isn’t all that beat up at all, but there’s a good case for its growth, and it serves as a fine example of what a resilient modern banking business can look like.

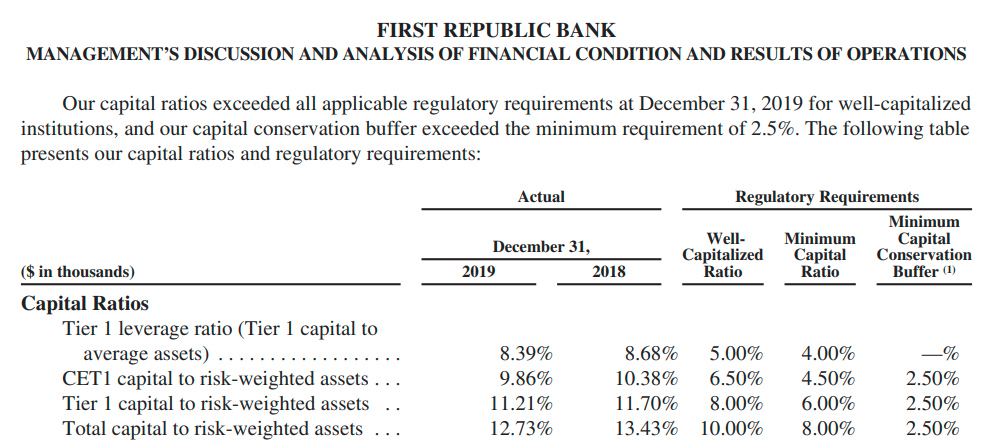

FRC’s capital ratio looks perfectly adequate to the Feds, and that’s to be expected of a local lender in the epicenter of the obscenely-rich tech hub.

The bank has cleverly compartmentalized its securities to give investors the option to invest in its growth or income or a mix. Several series of preferred depository shares pay between 4% and 6%.

These worked out splendidly as a value pick for those who bought them at the pandemic trough, but we try not to do too much looking back. The bank courts consistency by keeping the divvies steady on the various preferred share classes. First Republic issues new classes of preferred stock and buys out the old ones when they change the payout, isolating volatility from cuts and bumps, while keeping its main stock a pure representation of its value, suitable for those who want exposure to the company’s growth.

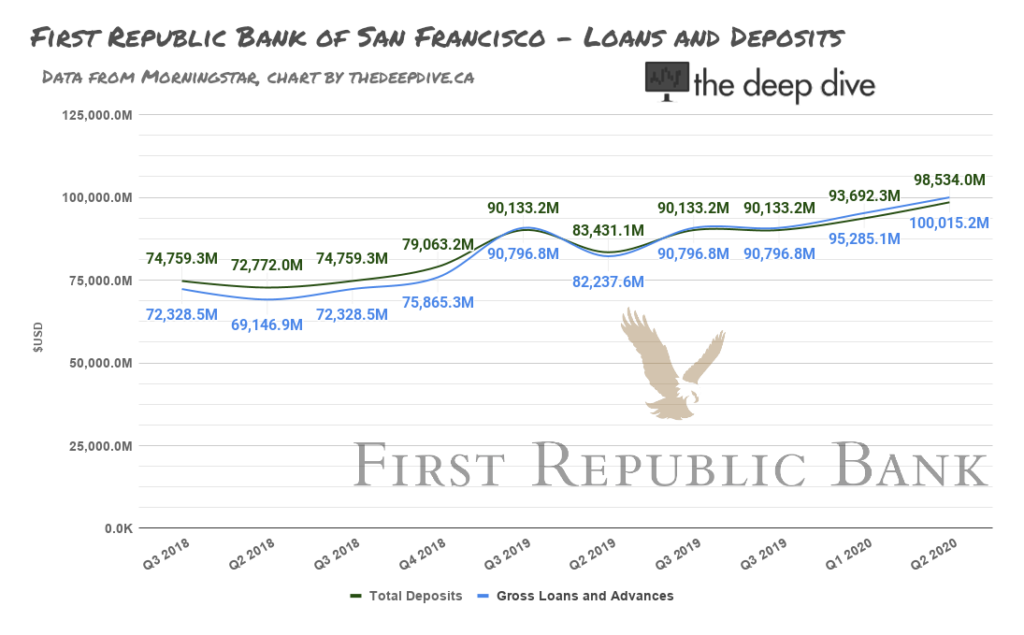

First Republic’s $22 billion market cap is about 2.2 times its book value, as it carves out a fairly steady deposit and lending business.

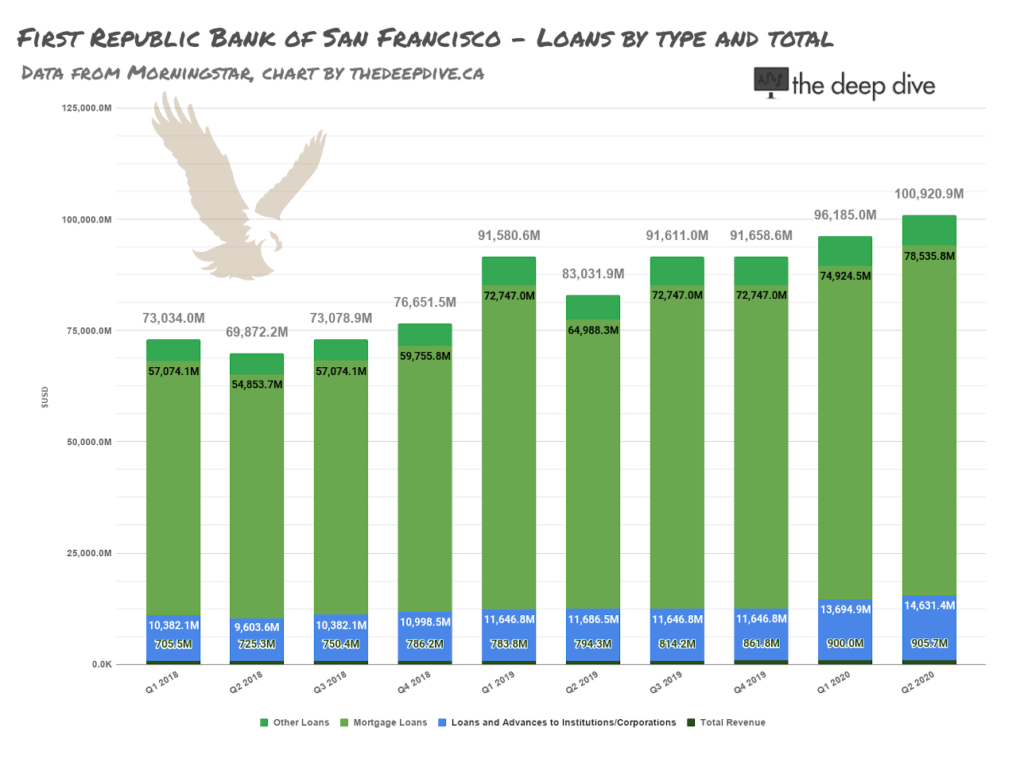

The loans are mostly mortgages and commercial loans, made on some of the highest value real estate in America, owned by people who work at some of the richest companies in America.

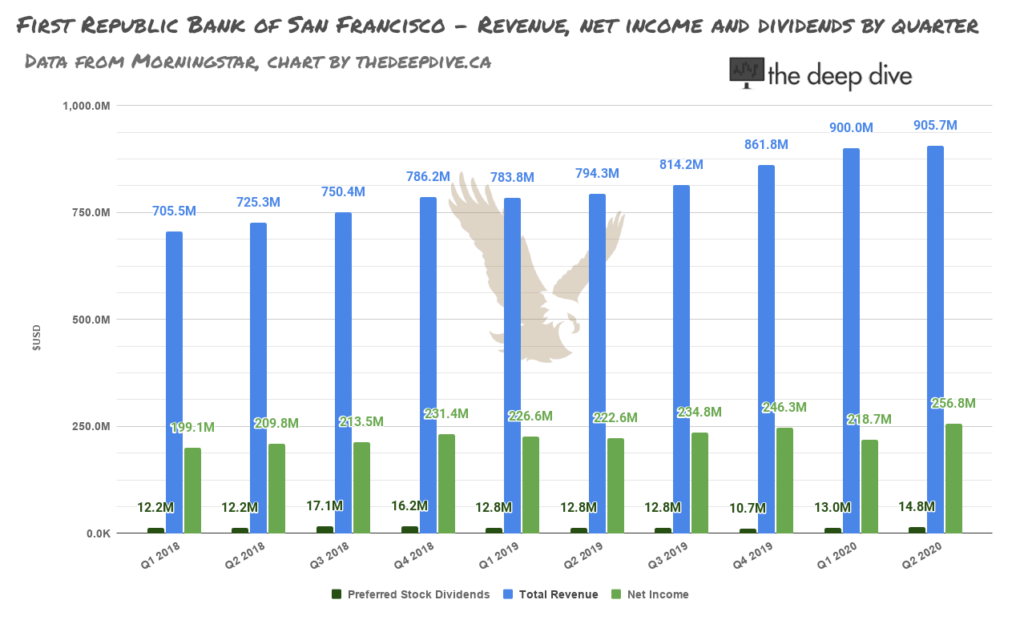

First Republic’s revenue is about as steady as one might expect out of Big Tech’s banker, pandemic or no pandemic. The company produces a nice, predictable bottom line that produces a nice, predictable set of dividends distributed through the aforementioned preferred depository instruments.

The First Republic common shares (NYSE: FRC) are trading at a 52 week and all-time high. They represent exposure to the brick and mortar economy that surrounds Silicon Valley tech businesses which, at the risk of putting too fine a point on it, include Google (NASDAQ: GOOGL), Apple (NASDAQ: APPL) and Facebook (NASDAQ: FB), which together represent 12.8% of the S&P 500.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.