Conversion prices for Zenabis Global (TSX: ZENA) debt just keeps getting lower. The company issued a late night news release Friday night, indicated that they had converted certain outstanding secured convertible notes at a rock bottom price of $0.04794 per common share, a figure below their 52 week low. Under the original terms of the transaction entered into in 2018, the debt was to convert at $2.52 per share.

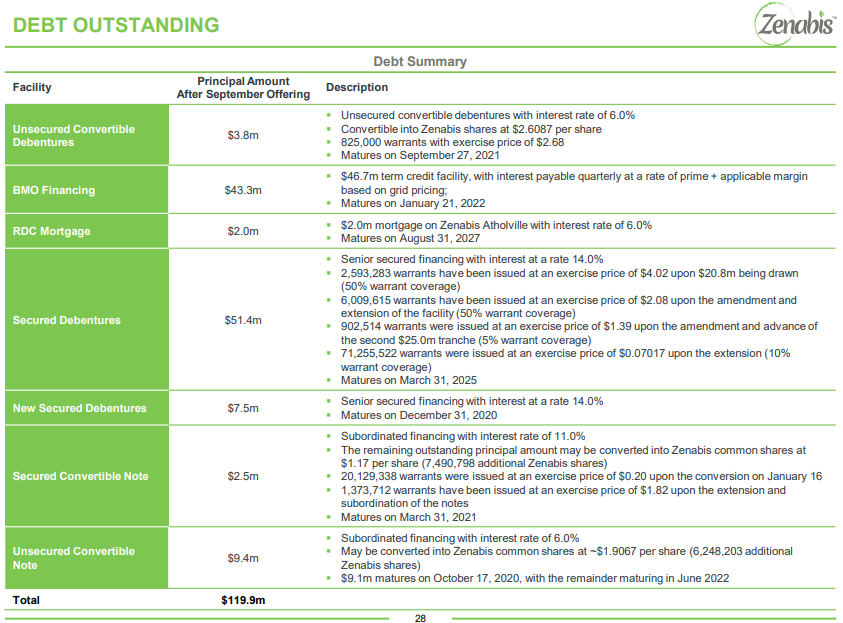

After several amendments that were conducted to the notes, the debt, as of June 1, was to convert at $1.17 per share, with the debt due by March 2021. However it appears certain of the noteholders have gotten restless given the performance of the equity, with certain holders, excluding Agentis Capital, arranging the early conversion with the company. That conversion however did not come cheap for Zenabis.

In total, 32,208,806 common shares of the company were issued at a price of $0.04794 per common share, representing a value of $1.54 million in both principal and accrued interest that was settled. Further, an additional 16,104,403 warrants of the issuer were given to the noteholders. The warrants have an expiry of five years from the date of issuance, along with a conversion price of $0.06768 per share, representing 70% warrant coverage on the debt as well.

While the warrants do have an accelerated expiry clause if the price of the equity exceeds $0.1356 for a period of 10 consecutive trading days on the TSX, this threshold is unlikely to be met given that the company recently raised $7.6 million at a price of $0.085 per unit. That offering resulted in a total of 89.3 million shares being issued, with an equal amount of warrants that have an exercise price of $0.10 – thereby providing likely heavy resistance to upward momentum at this point in time.

Zenabis Global last traded at $0.055 on the TSX.

Information for this briefing was found via Sedar and Zenabis Global Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.