It appears that the asset sale of Zenabis Global’s (TSX: ZENA) Delta facility isn’t exactly going according to plan. The company has listed the property with Colliers International, while having it featured on “UniqueProperties.ca,” an affiliate of the real estate firm. The listing appears to have been filed in early June, well after the April announcement that the company was looking to offload the asset.

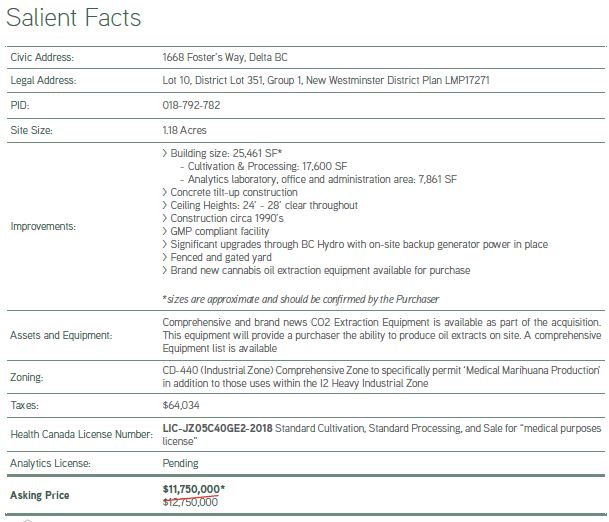

It seems that the company is looking to offload it in a hurry as well, with the sales price recently being reduced in mid-June from $12.75 million to $11.75 million. The sale is stated to include 1.18 acres, and consist of a 25,000 square foot facility federally licensed for cultivation, processing, and the sale of medical cannabis. A further license is said to have been submitted for analytic testing via an included on-site labratory as well.

Further details include that the building was originally constructed in the mid 1990’s, and saw conversion to a cannabis facility beginning in 2016. Licensed space includes 17,600 square feet of cultivation space, while 7,861 square feet is dedication to the lab, office space, and an admin area.

Additionally, it appears that Zenabis is also looking to offload certain extraction equipment in conjunction with the sale. In particular, brand new CO2 extraction equipment is available to be sold with the building among other equipment.

Notably the company is relying on the asset sale to repay a $7.0 million senior secured short term loan obtained in April, which was originally due for repayment on July 20. The debt maturity has since been extended to December 31, 2020 as a result of the delayed asset sale.

The full listing for Zenabis’ Delta facility can be found here.

Zenabis Global last traded at $0.08 on the TSX.

Information for this briefing was found via Sedar and Zenabis Global Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Hi – I am one of the listing agents for the facility. If you’d like updated information, you can reach me at Bianca.gilbert@colliers.com. Thank you and enjoy the rest of your Friday!